- Austin, Texas-based orthotics and prosthetic (O&P) service provider Hanger Inc. plans to issue a new $1.150 billion first-lien term loan to refinance its capital structure. The company will also raise a new $200 million revolving credit facility and $150 million delayed draw term loan, which we expect will be undrawn at close.

- We assigned our 'B' issuer credit rating to the company.

- We also assigned our 'B' issue-level and '3' recovery ratings to its proposed senior secured credit facilities. The '3' recovery rating reflects our expectation of meaningful (rounded estimate: 50%) recovery in an event of a payment default.

- The stable outlook reflects our expectation that the company's leading position in the industry and stable demand for its services in the coming years will support its revenue and EBITDA growth, helping Hanger maintain S&P Global Ratings-adjusted leverage below 6x and free cash flow to debt of at least 3%, despite its merger and acquisition (M&A)-based expansion strategy.

BOSTON (S&P Global Ratings) Oct. 7, 2024--S&P Global Ratings today took the rating actions listed above.

The ratings on Hanger primarily reflect its high leverage under the control of private-equity sponsor Patient Square Capital, partly offset by solid long-term prospects based on stable demand.Pro forma for the transaction, we expect adjusted debt to EBITDA will be elevated, at about 6x in 2024. However, ongoing acquisitions should translate into high-single-digit to low-double-digit percent EBITDA growth and leverage reduction to the mid- to high-5x area in 2025 and mid-5x area in 2026. Nevertheless, there is longer-term uncertainty around leverage reduction to below 5x given the potential for an aggressive financial policy under private-equity ownership. We believe excess cash flow could be used for shareholder-friendly activities, including dividends, rather than debt repayment.

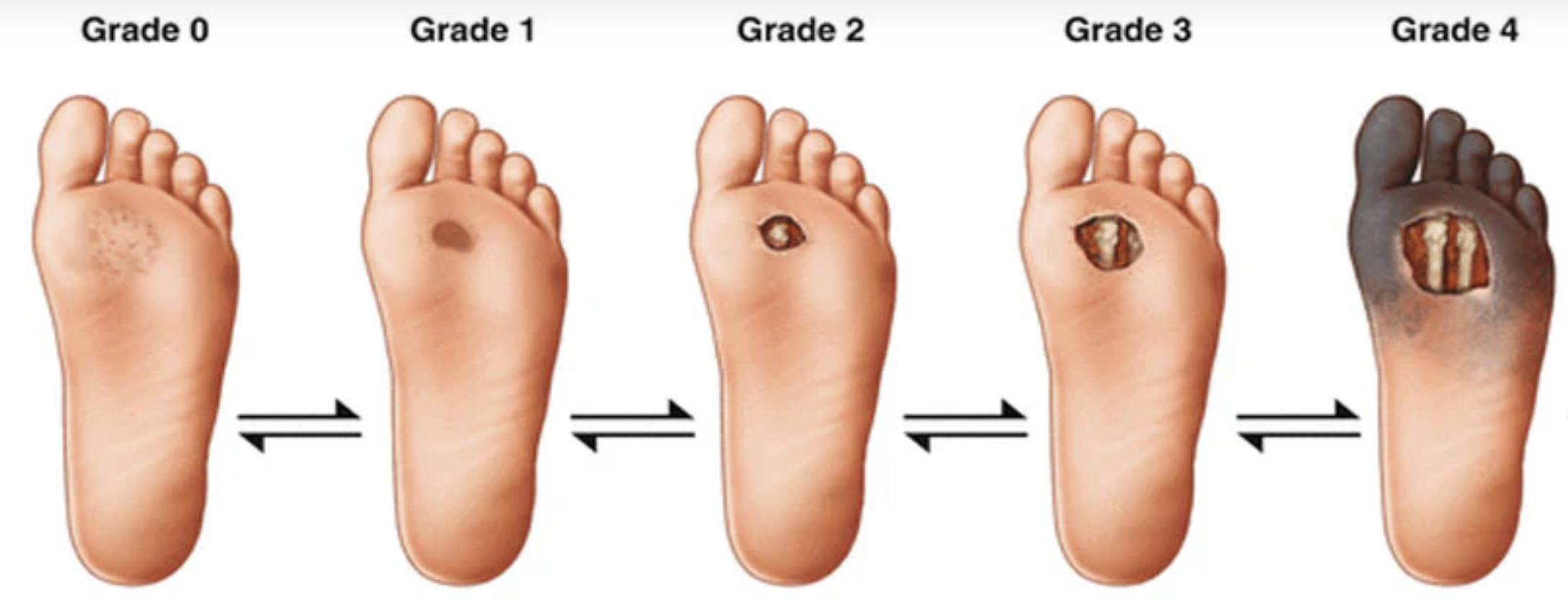

Since it is the largest provider of O&P services in the U.S., we believe Hanger is well positioned to benefit from stable demand trends. We believe demand for O&P services will be driven by ongoing maintenance and replacement cycles, prevalence of injuries and accidents, an aging population, and increasing incidence of disease. At the same time, we believe that the growing use of GLP-1s could reduce diabetes-related amputations longer-term, but the timing and magnitude of the impact remain uncertain.

Hanger is the largest provider of O&P services in the U.S.With locations in 49 states and annual sales approaching $1.5 billion, the company commands an approximate 25% share of the O&P market, which is significantly above that of its closest competitor. Although we view the nature of competition in O&P services as primarily local, Hanger benefits from a scale advantage, allowing it to negotiate more favorable reimbursement rates and purchasing terms with payors and vendors. We also believe that its scale and reputation differentiate it from smaller competitors, which helps the company attract, retain, and efficiently use skilled clinicians. This allows it to operate more efficiently, offering better returns on investment, especially in critical areas such as IT systems for processing reimbursement claims and logistics, compared with small O&P providers. In recent years, the company has upgraded its enterprise resource planning systems, as well as its logistic centers, further solidifying its leading position in the industry. These investments, as well the knowledge it gained over years in optimizing the reimbursement process, allowed it to maintain a relatively low level of declined claims (at about 4%-5% of sales). We also believe that over its long history of operations Hanger has established a large network of referring physicians, which adds to its competitive advantage.

We believe the company's previous investments in automation and its ability to navigate complex reimbursement and billing processes will enable it to maintain S&P Global Ratings-adjusted margins in 14%-15% range.We think the investments Hanger made in previous years to enhance automation and improve efficiency in processing reimbursement and billing, as well as its scale advantage in purchasing O&P devices, should enable it to maintain and gradually improve its profitability over time. We forecast the company's S&P Global Ratings-adjusted EBITDA margin will be in the 14%-15% range in 2024-2026 with good prospects for improvement thereafter.

Reimbursement risk is significant, but historical trends have been favorable.Hanger's exposure to potential adverse changes in reimbursement is significant, in our view. We estimate Hanger's payor mix includes about 60% exposure to government-related payors, albeit through contracts with various institutions (Medicare--16%, Medicaid--4%, Managed Medicare--17%, Managed Medicaid--13%, and Veteran's Administration--10%; in total, about 60%), about 35% commercial payer, and 5% patient self-pay. We believe the risk stems from Hanger's high reliance on government-related payors, and the government's ability to unilaterally reduce or introduce adverse changes to reimbursement, particularly given rising budget pressures.

At the same time, reimbursement developments in recent years have been favorable, including 3.4%-3.8% increases to the Centers for Medicare & Medicaid Services (CMS) Durable Medical Equipment and the Prosthetics/Orthotics & Supplies (DMEPOS) fee schedule in fiscals 2023-2025, compared with updates of about 1% over fiscals 2014-2021. We believe higher reimbursement updates reflect in part the nondiscretionary nature of the services but also the high inflationary environment in recent years (about 56% of Hanger's total reimbursement benefits from automatic Consumer Price Index-based rate escalators through the CMS DMEPOS fee schedule and related methods).

We believe GLP-1s could reduce diabetes-related amputations longer term, but the timing and magnitude of the impact remain uncertain.While O&P market demand is driven by multiple underlying diseases, injuries, or accidents, a high percentage of major amputations are caused by cardiovascular or diabetes-related conditions. We estimate that 40%-50% of Hanger's prosthetics business is driven by these conditions. Many patients with cardiovascular or diabetes-related diseases are also obese. The prescription of glucagon-like peptide-1 agonists, commonly referred to as GLP-1s, to treat type 2 diabetes was approved by the FDA in 2005 and to treat obesity in 2014. However, demand for GLP-1s has increased significantly of late because of their weight loss benefits. We believe the prescription of GLP-1s has the potential to lower obesity levels globally over time and thus somewhat reduce, over the long term, the diabetic population, in turn reducing the occurrence of major amputations. However, variables such as accessibility (given the current high cost and limited insurance coverage), pace of adoption, adherence, and drug side effects will likely determine how quickly and to what extent GLP-1s will alter market dynamics.

We forecast S&P Global Ratings-adjusted leverage to remain above 5x over the next couple of years given the company's private equity ownership and acquisition-driven growth strategy.Since being acquired by private-equity sponsor Patient Square Capital in 2022, Hanger has pursued multiple M&As, which have increased its geographic reach and scale. We expect the company will continue to prioritize growth through M&A and shareholder rewards over debt reduction. Following the proposed refinancing transaction, we expect S&P Global Ratings-adjusted debt leverage in the 5x-6x range. At the same time, we believe the company has established a track record of successful integration of the acquired entities, which supports its ability to increase earnings and maintain similar leverage going forward. We also believe that the improving interest rate environment should support the company's ability to generate positive free operating cash flow (FOCF), with an S&P Global Ratings-adjusted FOCF-to-debt ratio in 4%-6% range in the next couple of years.

The stable outlook reflects our expectation that the company's leading position in the industry and stable demand for its services in the coming years will support its revenue and EBITDA growth, helping Hanger maintain S&P Global Ratings-adjusted leverage below 6x and free cash flow to debt of at least 3%, despite its M&A-based expansion strategy.

We could downgrade the company if we expected its FOCF-to-debt ratio to decline to below 3%. This could occur due to prolonged margin pressures; weaker-than-expected patient volumes; material reimbursement cuts; or large, debt-funded acquisitions without sufficient EBITDA contribution.

Although unlikely given its private-equity ownership, we could raise the rating if Hanger reduced debt leverage below 5x, with a sponsor commitment to sustaining it at that level over the longer term.

Governance is a moderately negative consideration in our credit rating analysis of Hanger, as is the case for most rated entities owned by private-equity sponsors. We believe the company's highly leveraged financial risk profile points to corporate decision-making that prioritizes the interests of the controlling owners. This also reflects the generally finite holding periods and a focus on maximizing shareholder returns.