A British prosthetics manufacturer on a mission to make bionic arms accessible to people with limb differences, is set to accelerate its expansion in the US and DACH markets thanks to an innovative high-growth lending solution offered by NatWest.

Bristol-based Open Bionics has secured a £600,000 Intellectual Property backed loan from NatWest to open six more clinics in the US, helping more patients to access its life-changing Hero Arm. Open Bionics aims to increase accessibility for advanced bionic arms for the 70% of amputees who are believed to currently sit ‘outside the system’ – such as patients who abandoned their first prosthesis, were never referred to an appropriate care provider or were turned away.

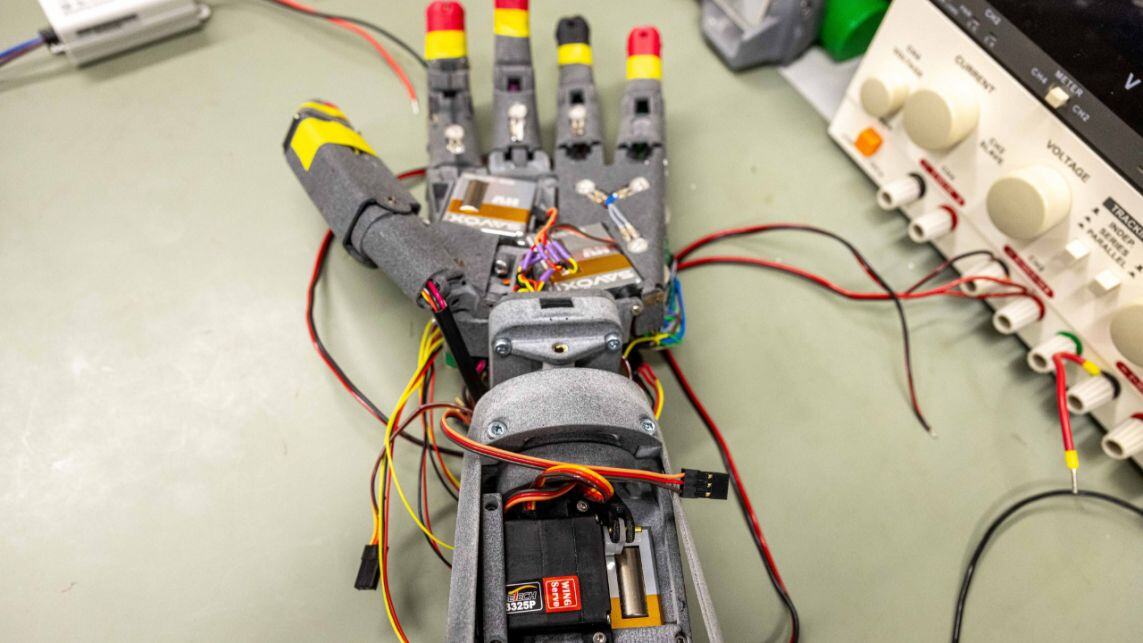

The Hero Arm has moveable fingers and thumbs that enable below-elbow amputees to pinch and grasp objects. It makes everyday activities like holding a bag or brushing teeth possible again for people with upper limb differences.

The assistive technology is controlled by EMG (ElectroMyoGraphy) sensors that are activated by muscles in the forearm. The arms are custom-made for the wearer and use advanced manufacturing techniques like 3D scanning and 3D printing, which enable the arm to have innovative new features like ventilation and adjustment of how tight/loose the arm fits.

Open Bionics, who won the European Healthcare Innovator Award last month in Germany, used the same method to create a 3D printed partial hand prosthesis called the Hero Gauntlet, and a waterproof sports arm called the Hero Flex.

Known for turning disabilities into superpowers, Open Bionics has manufactured robotic arms for children as young as five in the style of their favourite superheroes. The NHS has made the Hero Arm, Hero Flex and the Hero Gauntlet devices available to every patient across England, Wales and Scotland that meets their policy criteria.

Open Bionics secured the six-figure loan from NatWest using its intellectual property as collateral. NatWest is currently the only bank in the UK to accept IP as collateral on loans. Using valuations provided by the IP valuation firm Inngot, the bank is enabling scale-ups which lack tangible assets to use their intellectual property to secure the funding they need to power up their growth.

Samantha Payne, Open Bionics Co-founder and CEO (US) said: “We’re really excited to use this funding to supercharge growth in the US and make it much easier for our patients to access specialist care within their state by visiting their Open Bionics clinic.”

Louis Spencer, Relationship Director at NatWest, said: “We’re proud to support Open Bionics with the financing needed to expand its business overseas, enabling more children and adults to benefit from bespoke 3D printed prosthetic arms. It can often be challenging for scale-ups to access growth capital as often they don’t have fixed assets they need to secure lending.

“This financing solution bridges that gap by enabling scale-ups like Open Bionics to use their intangible assets – such as patents, copyright and trademarks – to secure lending. It has been estimated that IP intensive industries generate over a quarter of the UK’s output, equivalent to around £300bn a year, so this type of finance can make a real difference to the UK economy.”

Martin Brassell, CEO of Inngot, said: “Open Bionics’ Hero Arms may catch the eye because of the ‘superhero’ covers they feature, but it’s the tech underneath them that really transforms lives. Similarly, the intellectual property these prosthetics embody represents ‘hidden value’. It used to be hard for innovative companies to harness their IP for lending, but we’re delighted to support NatWest in identifying and unlocking its value so that game-changing products like this can scale internationally.”